Written originally for UK’s association Agriculture & Horticulture Development Board (AHDB) by Andrey Sizov

The start of the 2020 wheat harvest campaign around the Black Sea was a disaster. Both Russia and Ukraine were reporting yields around 30% lower than a year ago after a prolonged dryness period in spring which damaged crops in the region substantially. In the two weeks at the beginning of July, US soft red wheat (SRW) in Chicago rallied 13% while wheat in London and Paris gained 6-8%.

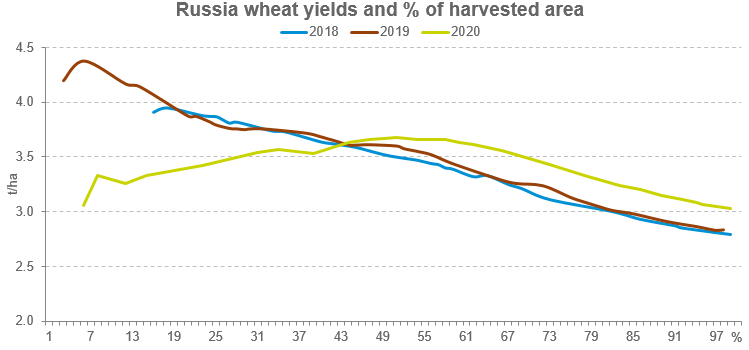

Whilst Ukraine’s yields improved and reached levels close to the previous year, the average yield in Russia remained at historically low levels. Many forecasters were cutting Russia’s crop estimates aggressively based on the low yields at the beginning of harvest. As a result, forecasts for Russia’s crop fell to 73-75 MMT at that time.

We at SovEcon, were warning the market that early yields were likely to be extremely misleading this year as early planted wheat suffered considerably more compared to the overall wheat crop in Russia and kept our estimates in an 80-84 MMT range throughout 2020. At the moment, it now looks like our optimistic estimates have been confirmed, the current consensus about the size of Russia’s crop is around 82-84 MMT, and USDA has just upped its crop forecast by 5 MMT to 83 MMT (at last!).

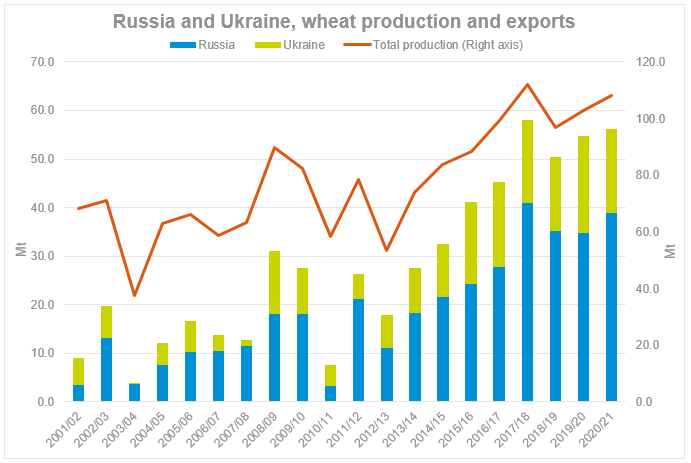

Our most recent estimate is 83.3 MMT (inc.Crimea with 0.6 MMT; USDA numbers exclude Crimea). The Ukraine wheat crop size is estimated at 24.8 MMT (USDA 25.5 MMT, inc.Crimea). Despite the challenging weather, the combined crop for Russia and Ukraine is expected to be around 108MT (+6% YoY), the second-highest crop on the record after 2017 with 112MT.

Total wheat exports for both countries are estimated at 56.1 MMT, marginally below 2017/18 record of 58 MMT. Russia is predicted to export 38.9 MMT and Ukraine 17.2 MMT (SovEcon).

Long term trend of bigger Black Sea wheat crops remains in place

This year confirms a longer term trend, the Black Sea remains a fast-growing grains powerhouse. If we talk about wheat, then the major driver is Russia. Wheat production in Ukraine grows at a slower pace whilst the country is rapidly expanding maize output.

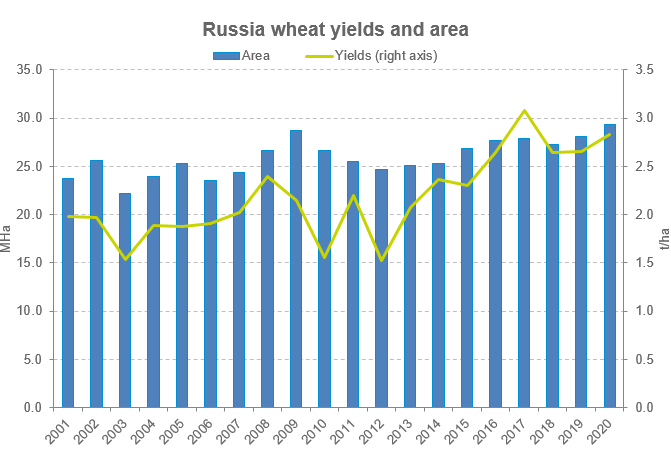

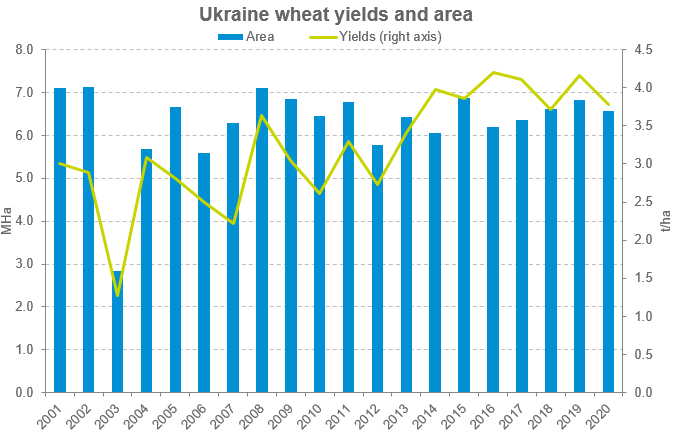

Increases in wheat production is driven by higher yields. In the last 20 years Ukraine has improved average yields by 60% and Russia by 40%. This trend is supported by better farming practices and gradually increasing levels of applied agri technologies. Russia also has been constantly increasing its wheat area which has increased by 17% since 2000, while in Ukraine it was mostly flat.

Global warming also has been a beneficial factor for the region as countries face milder winters and less winter kill. In addition, it allows Russia to increase the share of winter wheat in the total area which typically has higher yields compared to spring varieties.

2021/22 wheat crop outlook looks grim

The early outlook for 2021 doesn’t look good for the region. After a dry summer which substantially damaged late crops like maize, the Black Sea is facing a very dry autumn threatening the new wheat crop. In autumn almost all winter regions in Russia received no more than 20-40% of normal precipitation. Ukraine has also been relatively dry, especially in the East.

However, in late September much-needed rains arrived in the country helping farmers planting winter crops. If the rains had fallen at least 200-300 miles to the East, Russian winter wheat would look much better, but they haven’t.

In early October the outlook for 2021 Russian wheat crop looks poor. There are no rains in the forecast for the next weeks after a few months with minimal precipitation in many key wheat regions. This is especially true for southern regions in the Central Black Earth (Voronezh, Belgorod, Kursk, this year they are to produce around 10 MMT of wheat).

We estimate that Russia could lose 10-15% of its wheat area after the coming winter. The average winter kill was 4.8% for the previous five years with a range of 2.7%-8.7%. If there are no rains throughout October then the estimate could be upped even further. If we see some rains during October and the weather is warmer than normal in October-November then the estimate could be lowered.

Ukraine’s crop is in a poor condition but is now in better shape after the recent rains which helped winter wheat crops all over the country. More rains are expected to arrive shortly in the region.

As a result, at this stage, I would estimate that in 2021/22 Russia and Ukraine could harvest around 100-103MT (75-78MT in Russia + 25MT in Ukraine), a substantial decrease from 2020/21. (First SovEcon’s official estimate is to be released towards the middle of December, after the end of winter planting campaign has finished and the final assessment of crops’ conditions before the winter).

2022/23 and beyond: bigger crops and exports, UK could become a bigger market

Despite weather issues before the 2021 crop, in the mid–term we expect the Black Sea region to continue to outperform the rest of the world in terms of wheat production and exports. Improving yields are likely to remain the biggest driver as current yields are still 30-50% below the EU-28 average. Russia could continue to increase wheat area gradually, especially in the Volga Valley region which has substantial farmland reserves.

Key markets are likely to remain the same – fortunately for Russia and Ukraine there are many growing wheat consumers in Middle Eastern and North African regions which can’t increase their own production due to lack of moisture reserves. Iran could become a substantially bigger importer as the country is running out of moisture reserves and sooner or later will have to start saving them, implying a drop in domestic wheat production. (Under a similar scenario Saudi Arabia had to stop its heavily subsidized grain production program a decade ago and rely almost entirely on imports).

Algeria is now easing wheat bug damage import specifications opening the market to Black Sea wheat. South Eastern Asia is likely to remain a second key destination in terms of volumes with Indonesia and Bangladesh remaining the key buyers in the region.

Depending on import barriers the UK could become a more important destination for the Black Sea wheat, which can successfully compete with grain from Romania and Bulgaria, current big wheat suppliers for the country. Additionally, Russian higher protein wheat could compete with higher quality Canadian or German/Baltic wheat into the UK. Such exports could be conducted via new export terminals on the Russian Baltic shore which are now being constructed.